When you think about government constraints, what comes to mind? Money? Political will? Public opinion? Lack of staff?

In this edition, we’re diving into the constraints local governments face in developing budgets. This edition continues our series on government budgeting, drawing on a project we conducted with the Institute on Race, Power and Political Economy at The New School. If you missed our first newsletter in the series, check it out here!

If someone forwarded this to you and you’re not subscribed – subscribe here to make sure you get the next edition in the series.

When thinking about budgets, the first constraint that comes to mind is probably fiscal – individuals (and local governments) only have so much money.

Keep thinking and you can probably identify other types of constraints. Perhaps capacity constraints? For instance, in terms of your household budget, you may not have time to go to multiple grocery stores to get the best deals on each item. You may have time to do home repair projects but not the requisite skills. The latter may also point to “political will” constraints! You may have time and the purported ability to figure out how to do some repairs but not the will to do so. (Just me?) And then there are legal constraints – for instance, we are legally required to pay our mortgage and other debts.

Local governments face all these types of constraints and more. Below, we divide constraints on government budgeting into four categories: legal, fiscal, capacity, and social constraints.

Before we jump into those constraints – a quick and fun update. We just got back from Taiwan where we greatly enjoyed presenting to graduate students at National Taiwan University (NTU) about career paths outside of academia. It was a wonderful opportunity to learn about Taiwanese academic and professional culture, government research and data, and of course enjoy the food and the sights of Taiwan.

Thanks to Dr. John Chung-En Liu for arranging the seminar and to NTU’s Sociology department for hosting! It was our first international presentation, and it was a lot of fun!

Now, onto the main focus, budget constraints…

Legal constraints

Local governments impose legal constraints on themselves through ordinances, charters, and regulations. These rules often set the timeline for the budget and prescribe processes for amending and approving the budget. Some locales set rules about service levels, which have significant budget implications. For example, many locales set minimum staffing levels for policing – in 2020, San Francisco voters elected to remove police minimum staffing levels from their city charter but, in subsequent years, supervisors introduced a ballot measure to reinstate these minimums.

Legal constraints also come from the state government. In the federalist system, the power to create and regulate local governments is left to states. This gives state governments the final say on rules regarding how local governments set and approve their budgets. It also gives states an implicit veto over local government decisions through a power known as preemption.1

When you talk to local officials or advocates in some states about their budget, the first thing they mention is preemption (here’s looking at you Texas, Louisiana, Florida, Tennessee, etc.). Preemption hangs over budget deliberations because any decision made by a local government can be overridden by a sufficiently motivated state legislature.

Probably the most common constraint state governments place on local budgets is capping the ability to raise revenue by limiting local property taxes or restricting revenue sharing from sales tax. Another common constraint occurs when the state provides funding to local governments to deliver a specific program or service while setting requirements about the quality and conditions of that service. This is sometimes called “devolution” and occurs in policy areas like juvenile justice and K-12 education. Here funding comes with detailed rules about how it is to be used.

The federal government has less formal authority over how local governments operate but, by setting terms and conditions on the receipt of federal aid, it is able to significantly regulate some aspects of local budgets and program implementation. For example, federal aid from the Department of Housing and Urban Development (HUD) is often the primary or sole housing assistance spending in city government. Although regulations for this aid may not be identified in the budget, availability of this aid and its corresponding rules do shape the budget implicitly or explicitly.

A final source of legal constraints is…creditors. Local governments carry over $2.1 trillion in outstanding debt, more than their annual revenue.2 This debt—and the contracts signed to acquire it—creates legal (and fiscal) constraints. As a result, one primary purpose of the budget document is to make information available to creditors and communicate the continued credit-worthiness of the locale. This means the budget document and procedures may be adapted to meet the preferences of the county’s creditors or the wider municipal bond market. As with federal regulations above, these rules or preferences usually are not explicitly identified in the budget itself but are well known to financial experts or relevant staff within the local government.

Fiscal constraints

Unlike the federal government, state and local governments must balance their budgets annually. What fiscal constraints do they face in doing so?

Currently, one of the clearest constraints that local governments face is fiscal uncertainty. 2025 made clear just how much local governments depend on money from – and stability in – the federal government. Uncertainty about the amount of federal aid and its “strings,” and volatility in national and local economic conditions, create a strong pressure toward caution and small “c” conservatism in approaching local budgets.

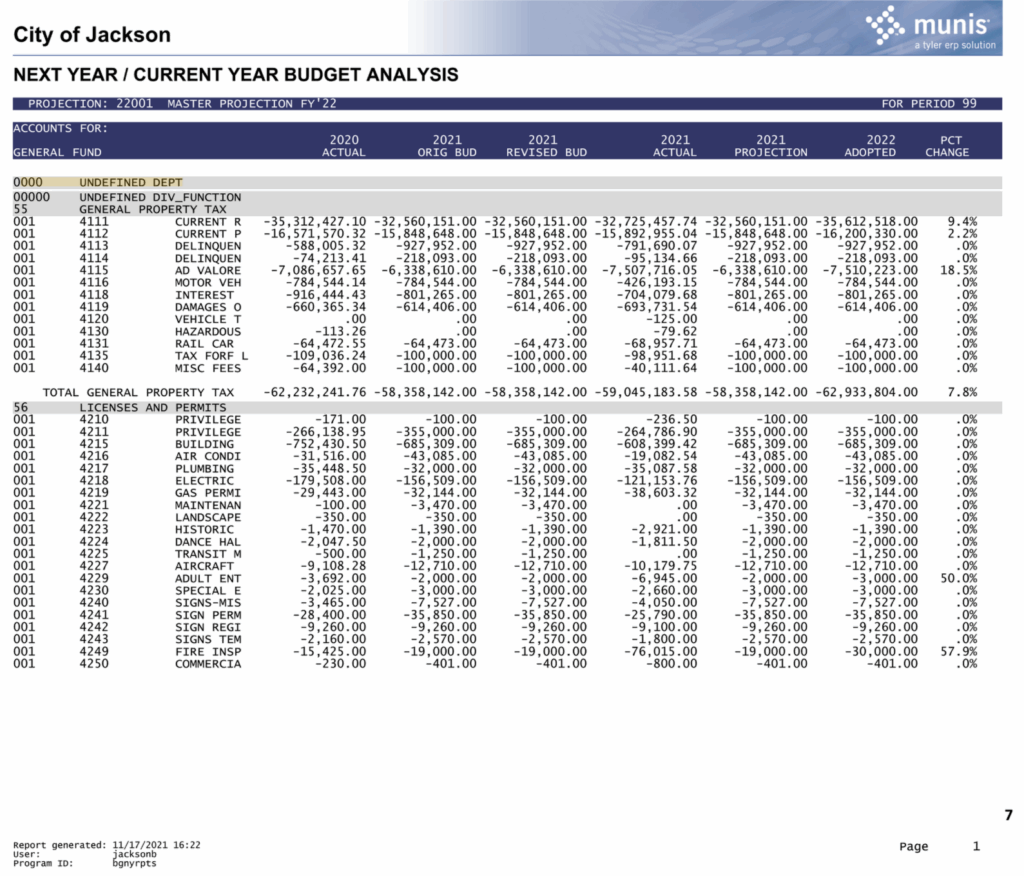

In local budgets, not all dollars are exchangeable. Certain revenue sources, such as specific buckets of federal or state aid, are subject to specific regulations. While a city’s “general fund” is comprised of general purpose dollars that can be allocated to any activity, other funds contain dollars earmarked for specific purposes. For example, a group of funds designated for “public safety” will be clearly appropriate for departments like police, fire, and emergency services. However, depending on the definition of the fund, its sources, and even the “expansiveness” of the views of the budget manager or elected officials, other departments may be able to access this funding for programs contributing to public safety broadly conceived, like a needle exchange program offered by the health department or a job program offered to “at-risk” youth.

A third fiscal constraint relates to financial implications over time – past debt must be paid down, money can (or cannot) be saved for a rainy day, and maintenance may be done on time or deferred. Local officials may find themselves constrained by a previous administration’s budget moves or by decisions made in prior budgets when fiscal conditions differed. Likewise, decisions about whether to spend on or defer maintenance, to construct a new facility (pay now but avoid higher future costs), or contribute to rainy day and budget stabilization funds may be made in one budget cycle but have ripple effects for years to come

At the margins there are also many opportunities to shift expenditures on either side of the fiscal year boundary to balance the budget. For example, contracts may be structured to pay out ahead of a fiscal year end date, a large purchase may be deferred until the next year, or supplies may be stockpiled using this year’s surplus.

Our favorite example of this “saved” California $3.2 billion one year. In 2024-25, the state of California deferred payroll for one day. By shifting payroll from June 30 to July 1, the state “saved” one month’s payroll…at least from the perspective of the 2024-25 budget. Like we said above, it just added $3.2 billion in costs to the next year!

The final – and perhaps biggest – fiscal constraint on local budgets is labor agreements. According to the GFOA, “[f]or many local governments, workforce costs represent more than two-thirds of their operating budget.” Labor agreements set pay scales, but also often dictate staffing levels, insurance coverage and plans, supplies required for each employee, and more. For example, police contracts often specify that officers receive extra pay for being assigned to a different unit or station than their regular assignment and can specify whether patrol cars have one or two officers. They can set minimum overtime requirements as well: past editorials have noted that the way to cut overtime spending is via contract negotiations, not through the budget itself.

Budgets do sometimes acknowledge labor agreements directly, but, just as often, a budget may obliquely mention increased staffing costs without ever saying that these costs were approved by elected officials in negotiations separate from the budget process.

Capacity constraints

Governments, even well-resourced ones, cannot do everything and must make choices in how to deploy their resources. There are real constraints imposed by both government staffing decisions and the realities of an annual budget timeline.

Local governments are multi-million to multi-billion dollar organizations, requiring extensive attention to fiscal reporting and financial controls. However, spending money on these administrative tasks – and then sharing the details with the public in a transparent, accessible manner – can sometimes be seen as taking money away from providing public services. Many local governments have limited staff available to monitor the budget, share details beyond a “print preview” chart-of-accounts, or evaluate alternative spending decisions. Additionally, local officials are often part-time, volunteer, or professionalized but with few dedicated staff. Without training in public budgeting or administration and, with limited time to devote to all the position responsibilities, elected officials may find it difficult to analyze the volume of information generated during the budget process – or to identify exactly what information on the budget is needed when.

Unfortunately, due to limit staff workload, budget updates during the year are often left as agenda items or committee reports rather than being compiled and published in a consistent format so the public (and even officials) can track approved spending throughout the year. Additionally, because actual spending is often shown on a two-year lag, sometimes it can take a year (or even longer) for the public and policymakers to know for sure if the budget was exceeded or funds misused.

New Orleans’ current budget woes appear to demonstrate some of these capacity constraints in action. While the city faces fiscal constraints as well (last year’s spending far exceeded the planned budget, and revenue was also less than expected), one of the biggest problems appears to be that officials themselves aren’t clear on the numbers and haven’t provided regular updates on revenue and spending throughout the year. In New Orleans’ case, the consequences may be drastic including layoffs, reduced services, and higher fees for services.

New Orlean’s example may also point to capacity limits in terms of what staff are trained and comfortable doing. Initiatives to boost local government capacity, as well as support innovation, include What Works Cities, Results for America, and Code for America. The latter two attempt to place trained policy analysts and software developers in partnership with local governments to solve challenges. These programs highlight one avenue to overcome capacity constraints but also point to how difficult it can be to implement new programs to meet a community’s challenges. In the face of uncertain success and many competing interests, it can be challenging for public officials to make the case for a dramatic change in course to solve local problems.

As a whole, then, lack of staffing resources and the hectic pace of annual budgets contributes to a tendance toward incrementalism and the status quo, requiring sustained effort and education on the part of elected officials or the public to overcome.

Social Constraints

Finally, governments operate in a social environment that also constrains their options. One social constraint is that governments rely on public input and trust (or at least public acquiescence). Local governments generally want to share information about services and seek at least some feedback from constituents. Yet, which residents provide public input to the budget process is generally very limited, and the most engaged citizens may be highly focused on one or two issues.

Public trust is crucial because much of what the government does is designed and carried out by technical experts. Expertise is necessary for good government – to do things efficiently, safely, and responsibly. However, technical expertise also limits public democratic participation. The terms of the program or services are often set by and designed for domain experts – doubly so when the domain is the intricate web of rules and regulations governing the budget. Public participation is often reduced to legally required comment-giving where public comments are recorded but public officials do not engage and the public receives no opportunity for deliberation with elected officials, experts, or one another.3

As a result, community members find themselves at a disadvantage in public decisions about how to allocate their community’s resources. Residents usually lack the time, network, and means to hire experts of their own, and they lack the credibility of professionalized experts themselves. For the government’s part, it can be difficult to tap into the local expertise of residents because of a lack of time and resources to thoughtfully engage, build trust and credibility, and balance competing concerns. The culture of professionalized policy evaluation can be seen as an attempt to shortcut this process but often results in the interests of those with the resources to hire experts being privileged. This is how a clear and simple public demand to build more publicly accessible drinking fountains can be met with requests for environmental impact studies, water quality upgrade plans, concerns about long-term sustainable funding for maintenance, and issues with shortfalls in the water infrastructure capital fund. To meet a seemingly simple demand, the public is sometimes expected to anticipate and address all possible issues before the government will take action.

If this analysis of budget constraints resonated or if you’ve seen how data gaps impede equity, transparency, or accountability in your community, reach out!

At Civilytics we help nonprofits, government agencies, and others build internal capacity to use data and translate complex documents like budgets into actionable information. We’ve done this for the Wisconsin Department of Public Instruction, PolicyLink, The New School and many more.

If you’re in search of research and data expertise to help move your good work forward, let’s schedule a 20 minute conversation about how we can help.

So where do we – and local governments – go from here? In the next edition or two, we’ll discuss how governments budget and how they navigate the constraints above. If you’d like a “sneak peak” at the answers in the form of an even fuller discussion of constraints, responses, and “best practice” examples, check out our full white paper on Local Budgets and the Forces that Shape Them produced for The New School and available on our website!

Additionally, if you have any suggestions for what you’d like us to cover regarding local government budgets or another topic, let us know! We’d love to hear from you and get some inspiration for future newsletters!

As always, thanks for reading. Wishing you all a good end to 2025 and all the best in the year ahead!

- A 2019 report by New America discusses preemption at length: https://www.newamerica.org/political-reform/reports/punching-down/ ↩︎

- U.S. Census Bureau, 2021 Annual Survey of State and Local Government Finances. ↩︎

- As an example from one of our partners in Phoenix, translation services by the city were inadequate, but the mayor refused to allow community members to supplement or replace the city-contracted translation services – making it difficult or impossible for Spanish-speaking residents to participate. ↩︎