What a doozy the start of this year has been.

While there is a lot to be concerned about and often frustratingly little we can do, we are energized by our work at Civilytics and especially the many community groups, advocates, researchers, and partners we get to meet, learn from, and sometimes assist.

Thanks for being part of our community and for spending a few minutes of your day with us and our newsletter.

In this edition:

- Kicking off a new collaboration with The Greenlining Institute

- Hannah is #opentowork, including new contract work as well as part- or full-time roles

- Our series on government budgets continues. At the new year, many people take a fresh look at their finances, and government budgets are no different in that way.

New collaboration with The Greenlining Institute

Have you heard the term “greenlining” before? We hadn’t until The Greenlining Institute reached out. The term is so evocative, though, that we immediately had a sense of what it means and what the Institute does!

While redlining refers to the discriminatory practice of excluding communities of color from economic opportunities based on race, The Greenlining Institute defines greenlining as “proactively driving investments and opportunities into communities of color.” Greenlining is focused on combating the impacts of historic redlining and building an abundant future where communities of color can build wealth, have access to economic opportunity, and are ready to meet challenges posed by climate change. They’ve been around for over 30 years and have worked with communities throughout California and the country.

At Civilytics, we’re thrilled to be supporting the Greenlining The Block (GTB) initiative which invests in and builds funding for community-led climate action projects. In 2024, GTB:

- disbursed more than $2 million in grants to 24 community partners

- helped these partners submit $40 million in funding applications for federal aid

- provided technical assistance to partners hiring experts for design, capital stacking, and more

Civilytics will be working with GTB sites to assess funding landscapes. We’re excited to help GTB partners identify strategies for funding community projects via local government dollars, state earmarks, federal sources, and more.

In 2026, we’re looking forward to learning from and contributing to Greenlining and their community of partners!

#opento contract, part-time, or full-time roles

Hannah is seeking additional contract work or a part-time (or potentially full-time) role. As regular Civic Pulse readers know, we lost a lot of federally funded research last February. While we were fortunate to find some additional work in 2025, I (Hannah) am missing the “anchor” project(s) that federal research previously provided. I like my work and would love to do more!

I am open to new contract work or part- or full-time roles. My background is in K-12 and higher education research, but I also have experience in other social policy areas like:

- Local government budgets and services

- Family wellbeing and supports, including afterschool/out-of-school programs and home visiting

- Youth justice and efforts to divest from detention and invest in community supports

- Capacity building for community groups interested in using data and research for advocacy

I’ve led research studies from start to finish, analyzed over 100 local budgets, designed surveys, conducted interviews, and written countless documents from reports to briefs to newsletters for a wide variety of audiences. I love research but also love leading project teams, strategizing about how to improve existing services, working with advocates to gather data and make the case for their programs, and more.

If you hear of any roles that I might be a good fit for, please reach out or pass my contact information along to others! You can reach me at hannah@civilytics.com – I’d appreciate any help!

New year, new budget? Continuing our series on government budgets

At the start of a new year – or end of an old one – do you evaluate how much you spent on different categories like housing, food, and entertainment, then make decisions about how to tweak your budget for the upcoming year? If so, you basically budget like local governments.

Despite periodic efforts at reform, most governments budget the same way: with a one-year focus on “line items.” According to the Government Finance Officers Association (GFOA) and International City/County Management Association (ICMA):

Local governments have developed their budgets in essentially the same way for decades. The essence of the traditional approach is, first, that the budget is incremental. This means that last year’s budget becomes next year’s budget with changes at the margin. Second, the budget is built around line items—categories of spending like personnel, commodities, and contractual services, which are then grouped into departments and funds. People have criticized this approach for almost as long as it has been in use with local governments (p. 1).

Just as we look at our household budgets by focusing on “line items” like rent and compare changes year-to-year, governments approach their budgets the same way. This incremental approach has many advantages. It’s:

- easy to understand whether line items have been over- or under-spent

- requires less effort, requiring consideration of only changes from the prior budget rather than the entire budget itself

- uses readily understood categories like “personnel spending”

However, the approach also has many limitations, as the GFOA and ICMA note. Limitations include the strong incentive to determine how much to spend on different activities based on historical precedent rather than on identified needs. Additionally, the focus is almost entirely on inputs with little attention to what services are actually provided.

For these reasons, various alternatives have been considered and sometimes tried by local governments. For example, zero-base budgeting (ZBB) “asks managers to build a budget from the ground up, starting from zero.”1 This approach sounds great in theory but is very labor intensive. Additionally, it creates interdepartmental competition (and potentially conflict) since each department is justifying its services each year.

Fun side note on ZBB and its connection to Kraft macaroni and cheese: This interesting Wall Street Journal article from the beginning of January reported Kraft Heinz used/uses zero-based budgeting and suggested this may have led to some underinvestment in macaroni and cheese R&D! This may explain why Hannah has been seeing a lot of open positions in consumer research at Kraft Heinz on LinkedIn 😉

Another alternative approach is “budgeting for outcomes.” This approach sounds great in theory as it asks local governments to identify their most important priorities and allocate resources accordingly. However, it can be hard to administer in practice since priorities/outcomes span departments, creating issues of “ownership,” and the most important outcomes may be hard to measure or achieve within one budget cycle.

Thus, most local governments persist with the tried-and-true but notably flawed annual, incremental, line-item budget.

One way government budgets differ from yours

“Fiscal year” is a term that applies to government and organizational budgets but not so much to household ones. It simply means the time period to which the budget applies.

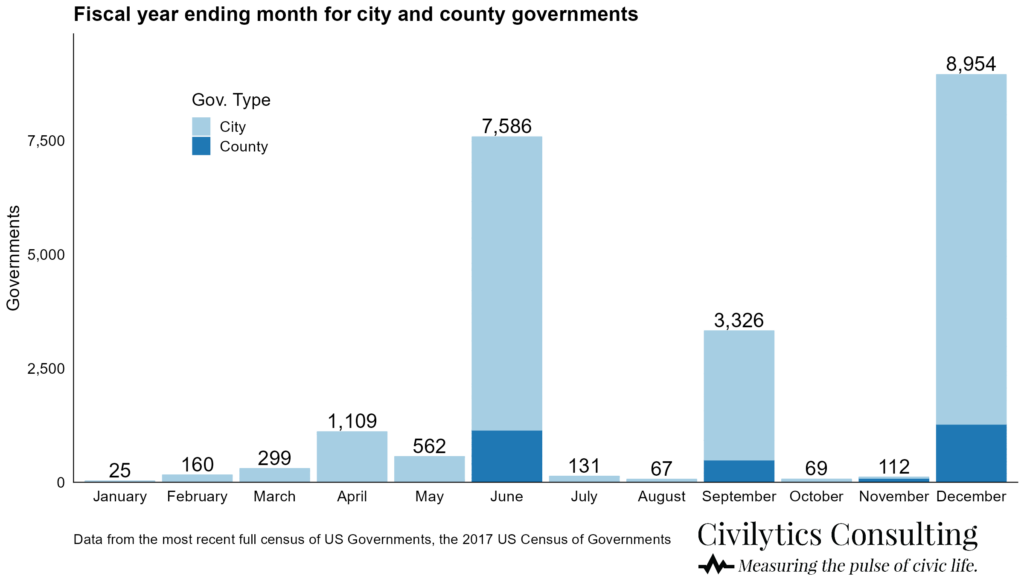

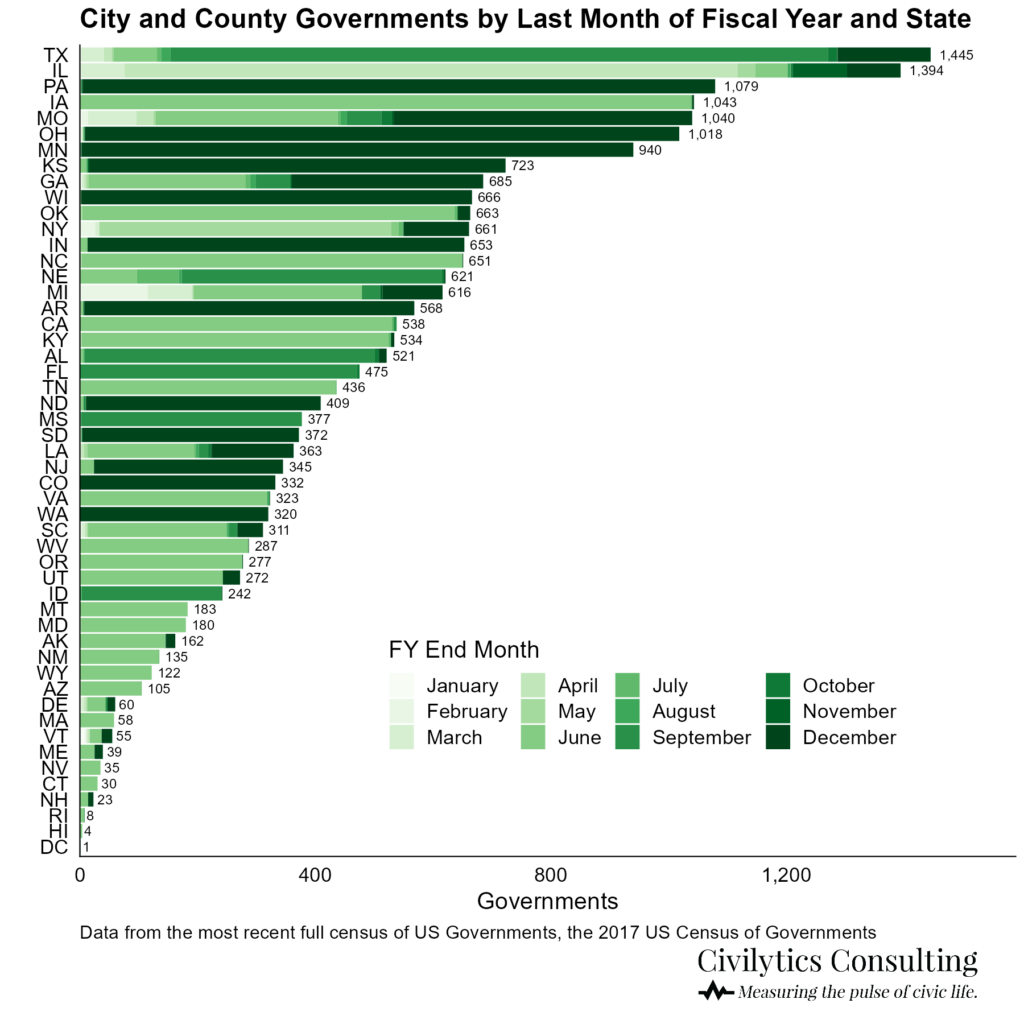

Nationally, just under half of local governments’ fiscal years follow the calendar year (from Jan. 1 to Dec. 31). For many local governments, the fiscal year is from July 1 to June 30, and fiscal years running from October 1 to September 30 are also fairly common. Interestingly, there is no month in the year that at least some local governments do not use as their fiscal year start.

Within the same state, local governments often have the same fiscal year start and end dates. For example, Figure 2 shows that, in California, most city and county budgets’ fiscal years run from July 1 to June 30.

How’s that for some random local government budget trivia?

In the next edition of the Civic Pulse, we’re thinking of dipping our toes into more controversial budget content. Perhaps praising and shaming particular local governments for good and bad examples of budget transparency? Or recognizing both the positives and limitations of participatory budgeting?

Look for that next time and thanks, as always, for reading!

1 Government Finance Officers Association. 2022. Why Do We Need to Rethink Budgeting? http://www.gfoa.org/rethinking-budgeting. Citing p.87 of Rubin, Irene, S. (2019). The Politics of Public Budgeting: Getting and Spending, Borrowing and Balancing. 9th Edition, Sage.