The U.S. Treasury has published the Final Rule for the Coronavirus State and Local Fiscal Recovery Funds program, established under the American Rescue Plan Act.

The Final Rule further loosens and enumerates the eligible uses of funds and keeps the timeline and general reporting requirements the same.

As before, there are four eligible use categories for funds, which we’ll briefly review with an eye toward changes since the Interim Rule.

1. Revenue replacement = use funds to provide any government services.

For this category, recipients are not required to provide any specifics about use of funds, meaning they can fund business-as-usual with minimal documentation.

The Final Rule includes two changes that make the revenue replacement category even more generous than before. It:

- Sets a higher expected growth rate of 5.2%. If the recipient’s revenue declined—or did not grow 5.2% over the selected period*—then recipients can use these funds to “make up” that lack of growth.

- Creates a standard allowance of $10M for revenue loss. This is entirely new and allows recipients to use up to $10M for revenue replacement regardless of whether revenue actually decreased.†

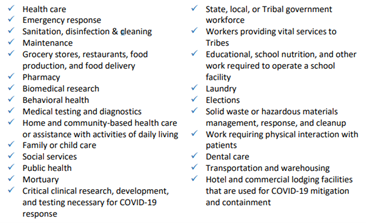

2. Premium pay for eligible workers performing essential work during the pandemic.

Premium pay can be up to an extra $13 per hour or $25k per worker. The Final Rule clarifies who is eligible – which is almost anyone who isn’t teleworking!

Workers in the sectors below are eligible if they’re regularly interacting with the public, co-workers, or items handled by others.

As noted in the Interim Rule, the pay for eligible workers should be no more than 150% of their state’s or county’s average annual wage but the Final Rule adds two options if this requirement is not met:

- The recipient can submit written justification describing why the worker is essential and should be eligible

- The premium pay can go to eligible workers who are not exempt from the Fair Labor Standards Act overtime provisions

3. Water, sewer, and broadband infrastructure.

The Final Rule broadens the projects that are eligible and gives more examples. Eligible projects include efforts to:

- conserve and reuse water

- reduce energy consumption at public plants

- harvest rainwater

- add green roofs

- repair culverts

- rehabilitate dams or reservoirs that have a role in the drinking water supply

- test for lead

- provide access to reliable broadband

- modernize cybersecurity

- and much more!

4. Respond to the pandemic’s public health and economic impacts.

This is the broadest category and the one where the most transformative new government activities can be funded. This category allows recipients to use funds to respond to the public health emergency; provide economic assistance to households, small businesses, nonprofits, or impacted industries; maintain the public sector’s capacity to deliver services and retain staff; and more.

The Final Rule adds to the list of eligible uses here including providing:

- support for childcare

- transportation to work

- assistance to start small businesses

- job training

- paid leave programs

- expanded health insurance coverage

- subsidies for internet access

- improvements to vacant lots

- programs to support long-term housing security

- assistance to industries like travel and tourism

- and much more!

Previously, funds could be used to rehire public sector employees up to pre-pandemic levels—the Final Rule extends this to allow hiring up to 7.5% above pre-pandemic levels.

Recipients can also use funds for worker retention incentives and for payroll and benefits for public safety, health, and human services employees for the portion of their time spent responding to COVID.

The Final Rule also clarifies that recipients may use funds for capital expenditures within this category—that is, capital projects related to the pandemic’s public health and economic impacts.

Restrictions on Use

As was the case before, recipients still cannot use funds to offset tax cuts, for deposits into pension funds, and for debt services. The Final Rule also states that:

- Allocations cannot be used to replenish rainy day funds, although they can be used to replenish unemployment insurance trust funds.

- Construction of new correctional or congregate facilities, convention centers, or stadiums will generally not be eligible.

Timeline and Reporting

The timeline remains the same: funds must be obligated by the end of 2024 and expended by the end of 2026. No noteworthy changes in reporting requirements seem to have been made—if anything, some reporting requirements were slightly relaxed.

Learn more about eligible uses of funds, the amount your government is receiving, and ideas for transformative ways to spend the funds!

- *Local governments can choose one of four periods for the revenue comparison.

- †As Treasury’s overview points out, for most, if not all, smaller cities and counties with <50k residents this will cover their entire award: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule-Overview.pdf.