Jared recently talked with Leanpub co-founder Len Epps on the podcast Frontmatter. Below are 5 facts Jared shared in the episode, with an excerpt from the interview about each and some photos Jared’s taken.*

Listen to the podcast:

1. Being From Montana Shapes Jared’s Thinking Today

I think geography is a really big part of what I do now, and also my origin story. I was born and raised in Montana… I grew up in a small town , and I moved to a smaller town to go to high school. What I saw when I changed towns was how different the school system was. As a kid, you’re very plugged into the school system, and so you can get a real sense of the differences between how adults in the school system are acting when you move…. And I thought, “We’re still in the same state, we’re still generally the same kinds of people or the same economy. Yet these two towns had very different school systems.” It got me really thinking about politics and school boards.

2. Jared Got His Start in Government as an Intern on WI’s Race-to-the-Top Application

“[The] idea of getting to work in the governor’s office, that sounded pretty interesting for me as a political scientist, a chance to see what it really looks like. I was just helping a team write an application. But I made a few graphs for the application, and they really liked that. They were like, “Oh, wow. These graphs are useful.” Looking back now, I could have done them in Excel or something — it wasn’t anything really fancy. But they liked that, and they said, “Why don’t you come do an internship at the state education agency?”

So, I started off working part-time, and then I started working full-time and doing my graduate degree part-time, and just transitioned. But I always had my foot in both of those worlds — which was a really interesting experience, and really did shape a lot of the way I think about what Civilytics does now, thinking about the importance of being a bridge between those two different worlds, and how they can help each other, and the ways they can lose track of communicating with each other.

3. Learning R Involved Some Methods Courses…and a Lot of Self-Teaching

I did pursue several courses in my methods sequence, and then went beyond it, to keep taking courses…so that I could learn how to use R to do different things, like geospatial statistics, and multi-level models, and all kinds of different tools, that just allowed me that space to learn.

I mostly used books [to learn R], some key books — and a lot of hands-on time at work — luckily my supervisors gave me the space to really solve a problem well, and use R to do it, and then learn from that experience.

4. EDDR Coauthors Jared, DJ Cratty, and Wendy Geller Met at an IRL Conference

We met at a conference. We’re all trained as social scientists, in this very academic tradition, but found ourselves drawn to this very practical work of working in government.

We were at a meeting for government data analysts to share ideas and talk about data systems, and how we do our work. But the meetings mostly tended to focus around really IT stuff, which is critical, and we have a love letter to IT professionals in the first book…but there wasn’t space to talk about how to be an analyst, including making friends with the IT department.

So we were coming out of this academic training, where the concept of data is like a dataset that has been carefully collected and manicured and perfectly laid out like a bonsai tree, that you would then analyze. The data we were dealing with is just like data that’s coming off of these systems that are trying to work every day, and they have different conflicting definitions. So we were like, “We weren’t really trained for this.”

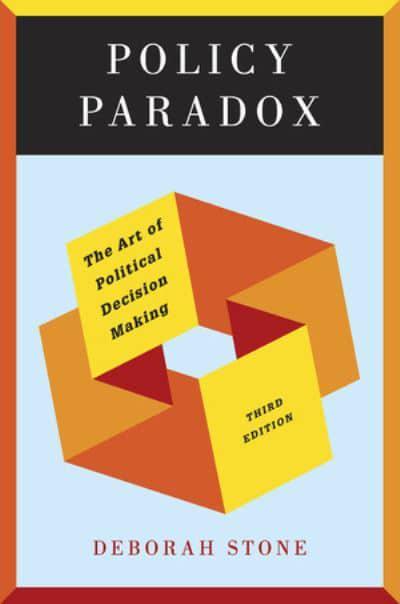

5. Jared Thinks the Policy Paradox Is the Greatest Political Science Book Ever Written

There’s a book by Deborah Stone called Policy Paradox, and I think it’s probably the greatest political science book ever written. I really hope she hears me say that someday. Because you can open up to any chapter, and it talks about all of these issues about, well, when we want to try to measure performance, there’s a political purpose to that, and there are people who are going to win and lose from that strategy. There are people who have legitimate complaints, and people who have like complaints that are made up — that are false, that are crying crocodile tears.

She looks at these problems from many different lenses, and shows you how and why they are so difficult to disentangle, and why it does seem like what starts out as a well-meaning policy, which I think 90% of people would agree about — like scam universities are a problem and we don’t want to have them — can be shaped and used to make [other] universities start to function in ways that we would not find optimal or useful or productive to society. I think that’s also one of the big fundamental paradoxes of making decisions about public goods.

Check Out the Wide-Ranging Interview

In the interview, Jared reminds us that we live in a republic not a democracy, shares why a simple graph takes 8 hours to get right, and more. We hope you’ll check it out! Thanks very much to Len and Leanpub for the very engaging interview!

- *Plus one photo from W.W. Norton publishers